Dealing with your apartment residences feels messy when every invoice, repair, and receipt finally ends up in specific locations. You want to understand wherein your cash is going; however, among tenants, taxes, and protection, it’s easy to lose track. Many landlords sense the same frustration when their books don’t upload at tax time.

This guide walks you through everything you need to know about rental property bookkeeping. You’ll learn how to track expenses, budget smarter, and stay tax-ready with less effort. We’ll also show how Baselane can simplify it all, saving you time while keeping your finances organized.

Table of Contents

Understanding the Importance of Rental Property Bookkeeping

Good rental property bookkeeping gives you a clear picture of how your properties perform. It facilitates you noticing which units earn well and which drain your earnings. Without organized facts, you risk neglected deductions, faulty reporting, and negative coins going with the flow control.

Landlords use bookkeeping to tune rent income, preservation prices, and each dollar spent on operations. It is the bureaucracy that is the muse for monetary selections like lease modifications, renovations, and long-term investments. When your records are accurate, you stay in control.

Introducing Baselane: A Platform Built for Rental Property Finances

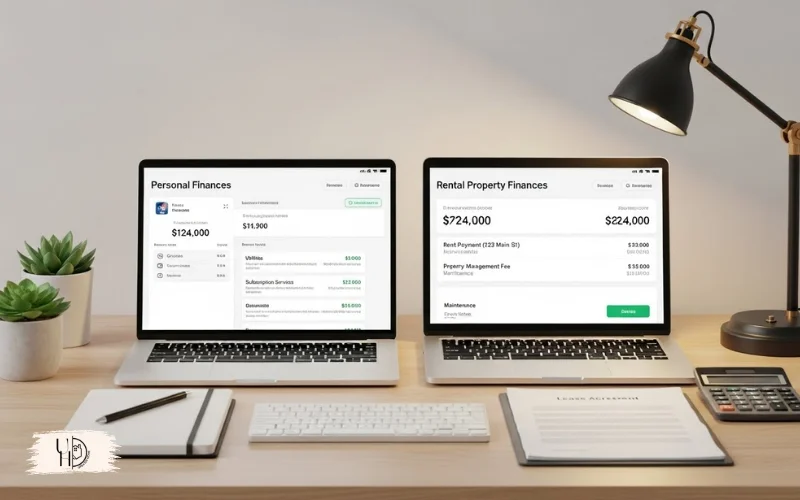

Baselane is an all-in-one financial platform built specifically for landlords. It combines banking, bookkeeping, rent collection, and analytics under one dashboard. You can link your accounts, track every expense automatically, and manage all transactions in real time.

Unlike general accounting tools, Baselane understands property management. You can categorize each expense by property, automate digital rent collection, and generate financial statements instantly. It replaces scattered spreadsheets with a clean system that saves hours every month.

Step 1: Separate budget and set up clear shape

Mixing personal and rental funds is one of the biggest mistakes landlords make. You should always keep separate bank accounts for your rental business. This makes tax filing easier and provides a clean financial trail for every property.

Baselane lets you open free checking accounts and sub-accounts for each property. You can track rent deposits, mortgage bills, and maintenance one after the other. This shape keeps your bookkeeping organized and obvious from day one.

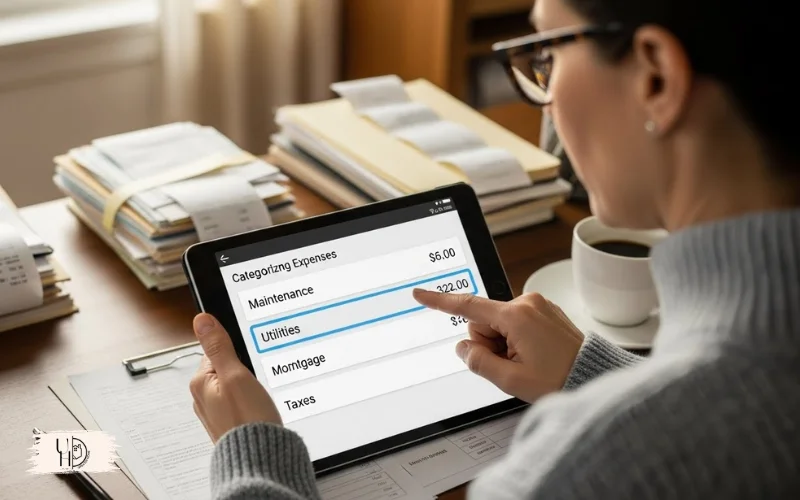

Step 2: Track and Categorize Every Expense

Each price, from light bulbs to roof upkeep, influences your bottom line. Correct categorization is prime to know-how in which your cash goes. Classes include upkeep, coverage, utilities, taxes, and expert charges.

Baselane automatically imports and sorts your transactions. You can label every payment, attach receipts, or even assign healthy fees to precise homes. This saves time and decreases human mistakes as compared to guided spreadsheet tracking.

Step 3: Budgeting & Reserving for Future Expenses

Condo residences usually convey surprises. A smart landlord plans beforehand by way of putting apart a price range for destiny maintenance and emergencies. Create a protection reserve account or assets protection fund for fees like HVAC servicing, plumbing maintenance, and landscaping.

Professionals advocate saving 1% of your property’s cost yearly for upkeep. With Baselane, you may automate transfers to a reserve account and tune how muchyou’ve set apart. Budgeting this way prevents coins from going with the flow shocks when upkeep seems all at once.

Step 4: Controlling and Reducing Expenses

Value manipulation begins with visibility. While you could see every habitual charge and protection price, you may cut waste speedily. Search for replica services, excessive software bills, or companies charging above-market costs.

Baselane’s reports make this simple. You can compare monthly expenses, spot unusual spending patterns, and analyze each property’s operating costs. Use this information to negotiate higher dealer contracts or regulate budgets to keep healthy income margins.

Step 5: Generating Reports & Using Data for Decision Making

Your bookkeeping facts become an effective decision device when prepared efficiently. Reviews like profit and loss statements and cash flow summaries help you recognize overall performance trends. those insights show which houses earn the maximum and which need interest.

Baselane generates real-time financial reports with a few clicks. You could export statements, compare durations, and calculate ROI for your apartment portfolio. Facts turn guesswork into an approach, helping you make investments smarter and develop with a bit of luck.

Step 6: Preparing for Tax Time and Compliance

Tax season is simpler when your statistics are smooth. Every deductible expense should be logged throughout the year, including maintenance, insurance, interest, and property taxes. Tracking these early saves stress later.

Baselane helps you categorize deductible property expenses automatically. You can generate Schedule E-ready reports and see all transactions by category. Accurate data reduce audit hazard and ensure you don’t leave out precious landlord tax blessings.

Not unusual Pitfalls and the way to avoid Them

Many landlords forget about small expenses that add up through the years, like pest management or seasonal landscaping. Others fail to differentiate between repairs and upgrades, mainly due to wrong tax reporting. Blending non-public and apartment expenses is every other steeply priced mistake.

You could avoid those issues with the aidl of automating your bookkeeping. Use digital systems to record every transaction, returnreceipts, and separate classes. The more regular your system, the fewer financial surprises you’ll face.

- Track every small recurring rate, which includes pest control, garden care, and seasonal maintenance.

- Separate maintenance from improvements to ensure correct tax deductions.

- Hold personal and condo prices in distinct amounts owed to avoid confusion.

- Use computerized bookkeeping tools like Baselane to simplify monitoring and reporting.

- Keep digital copies of all receipts for easy admission at some point of audits or tax submissions.

- Review your cost classes monthly to spot mistakes or missing entries.

- Hold regular report-maintaining behavior to save you end-of-year pressure.

Choosing the Right Bookkeeping and Expense Management Platform

Deciding on the right tool relies upon your portfolio size and goals. Manual spreadsheets work for deciding property but fail as your holdings grow. You need automation that reduces time spent on data entry and increases accuracy.

Baselane provides this balance. It syncs along with your bank money owed, tracks expenses routinely, and creates clear reports. It’s designed for landlords, no longer standard agencies, so every characteristic helps belongings-degree monitoring and expense control.

Real-World Example: Implementing Efficient Expense Management

Keep in mind a landlord handling 5 condo devices and the usage of spreadsheets and paper receipts. Each tax season took weeks of sorting and guessing. After switching to Baselane, all income and expenses synced automatically. The system generated profit and loss reports instantly.

Within months, the landlord spotted overspending on maintenance and saved hundreds by switching vendors. The time saved was redirected toward improving properties and finding new investments. Green bookkeeping created both financial savings and opportunities.

FAQs

What’s the best way to control apartment belongings bookkeeping?

Use a system that automates monitoring and categorization. Platforms like Baselane handle transactions, reports, and tax prep automatically.

How often should I update my rental property records?

Update them weekly or in real time using connected tools. Consistency prevents errors and keeps your financial data accurate.

Am I able to use Baselane for more than one apartment property?

Sure. You could create sub-bills for each property, list song costs one after the other, and consider combined overall performance reviews.

What fees are deductible for landlords?

commonplace deductions encompass upkeep, insurance, loan interest, utilities, control expenses, and depreciation. continually verify with IRS guidelines.

How does excellent bookkeeping improve ROI?

whilst you music charges correctly, you notice inefficiencies and keep cash. higher statistics cause smarter pricing, fewer mistakes, and better income margins.

Conclusion

Bookkeeping isn’t paperwork, it’s economic manage. With proper organization, you can see where your money goes and make decisions based on facts, not estimates. Accurate records also protect you during tax season and boost long-term profitability.

Baselane makes rental property bookkeeping simple. It automates expense tracking, keeps finances separated, and generates clear reports that help you manage smarter. If you want your rentals to run like a real business, it starts with better bookkeeping.